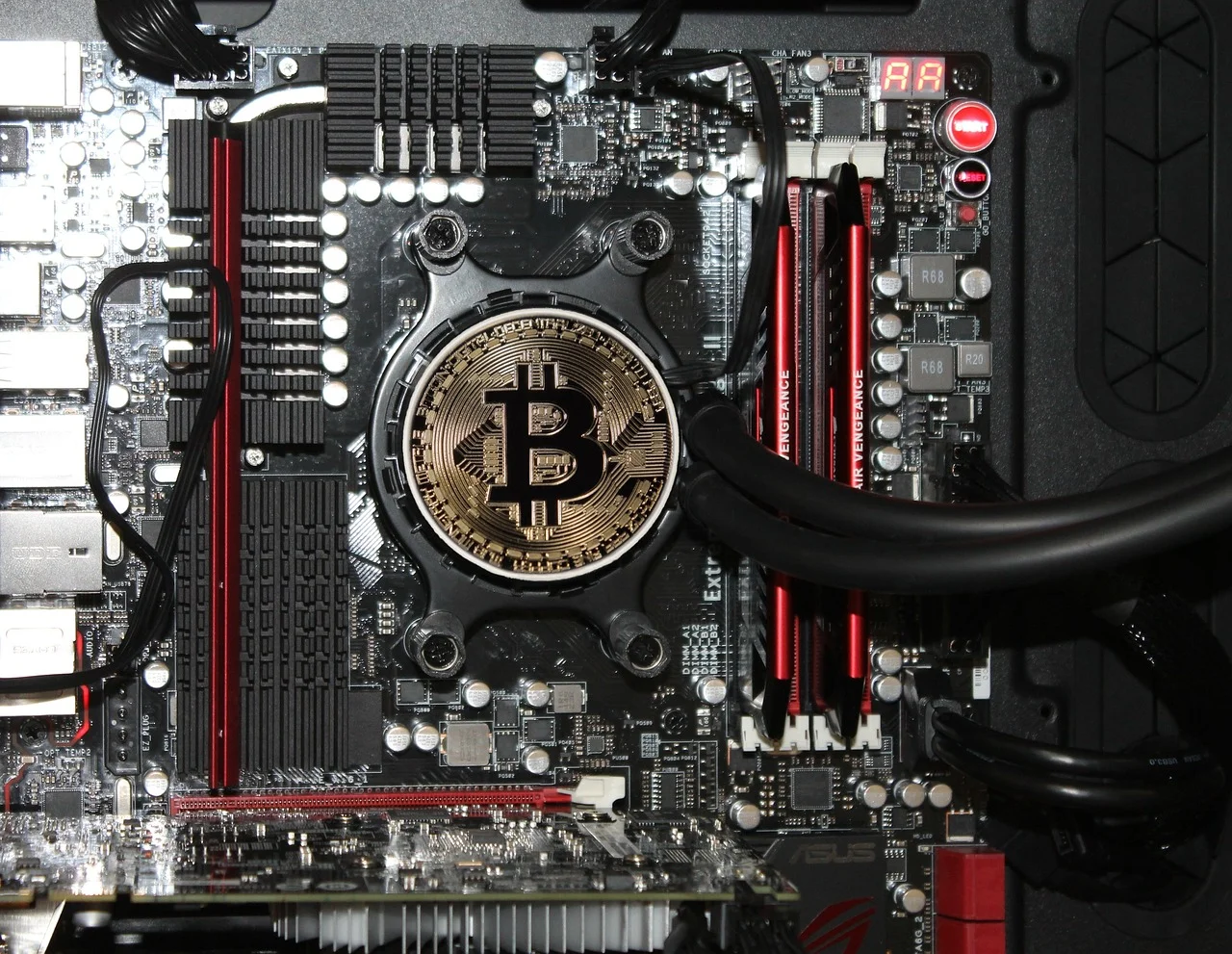

Unpredictable Bitcoin Price Surges and the Excitement of Growing ETF Demands

Bitcoin, the world’s most famous cryptocurrency, has been making waves in recent years with its unpredictable price surges. These sudden price movements have created a sense of excitement among traders and investors alike. Furthermore, the growing demands for Bitcoin exchange-traded funds (ETFs) indicate that interest in the digital currency is on the rise. In this article, we will explore the factors behind these surges and look at what the future holds for Bitcoin and ETFs.

Key Takeaways:

The Bitcoin Price Surge Phenomenon

Bitcoin’s journey from obscurity to mainstream fame has been marred by its widely known price volatility. While it can be frustrating for investors seeking price stability, the unpredictability is often the source of excitement. Whales, large-scale cryptocurrency holders, frequently exploit this volatility for their gains. They manipulate the market, creating sudden surges or crashes in Bitcoin’s price to capitalize on the swings. This activity contributes to the sense of thrill experienced by those involved in cryptocurrency trading.

Additionally, social media plays a significant role in fueling the excitement around Bitcoin’s price surges. From influential figures like Elon Musk tweeting about cryptocurrencies to online communities discussing the potential of Bitcoin, the chatter surrounding the digital currency amplifies every move it makes. As a result, more and more individuals are drawn to the action, eager to join the bandwagon.

Rising Demand for Bitcoin ETFs

Understanding ETFs

The concept of an exchange-traded fund is not limited to Bitcoin; it applies to various types of assets. In the case of cryptocurrency, a Bitcoin ETF would allow investors to gain exposure to Bitcoin without directly owning the digital currency. Instead, they can buy shares of the ETF, which represents a fraction of Bitcoin’s value. This accessible investment instrument eliminates the need for investors to manage a digital wallet or navigate the complex process of purchasing and securely storing Bitcoin.

Benefits of Bitcoin ETFs

The increasing demand for Bitcoin ETFs stems from several advantages they offer to investors.

Diversification: Including Bitcoin in an investment portfolio can provide diversification, as it is unrelated to traditional asset classes like stocks and bonds.

Liquidity: Unlike purchasing physical Bitcoin, which requires finding a safe and reputable exchange, Bitcoin ETFs can be bought and sold on regular stock exchanges.

Regulated Framework: ETFs fall under stringent regulations, which offer a level of protection for investors against fraud and misconduct.

Accessibility: Bitcoin ETFs provide an easier entry point for individuals who are interested in investing in Bitcoin but are unsure about navigating the intricacies of purchasing and holding the digital asset.

Factors Behind Bitcoin Price Surges

Market Sentiment

Market sentiments frequently play a major role in Bitcoin’s price movements. News of significant institutional investments or influential figures endorsing Bitcoin can drive increased buying interest, leading to price surges. Conversely, negative news or regulatory actions may cause panic selling, driving the price down.

Institutional Adoption

Institutional investments in Bitcoin have been instrumental in driving up its price. Major financial institutions, such as MicroStrategy and Tesla, have allocated a portion of their assets to Bitcoin. This institutional adoption signals Bitcoin’s potential as a store of value and has validated it as a legitimate asset class.

Hedge Against Inflation

Bitcoin’s finite supply and decentralized nature make it an appealing hedge against inflation for many investors. As traditional fiat currencies face the risk of losing value due to expansive monetary policies, some investors turn to Bitcoin as a potential safeguard for their wealth. This perception of Bitcoin as a store of value and a hedge against inflation further contributes to its price surges.

Frequently Asked Questions

Conclusion

In summary, the unpredictable price surges of Bitcoin have undoubtedly instilled excitement among traders and investors around the world. The intersection of social media hype, market sentiments, and institutional adoption all contribute to these sudden price movements. Simultaneously, the growing demand for Bitcoin ETFs indicates a significant interest in the digital currency from a diverse range of investors. As Bitcoin continues to capture the attention of the financial world, its future and potential impact on traditional financial markets remain the subject of fascination and excitement.

Source: insightfullgo.com